Washington, DC – The latest reports indicate a significant cool in the inflation rate in May, marking its lowest annual level in over two years. This shift is expected to alleviate pressure on the Federal Reserve to escalate interest rates, as indicated by the Labor Department on Tuesday.

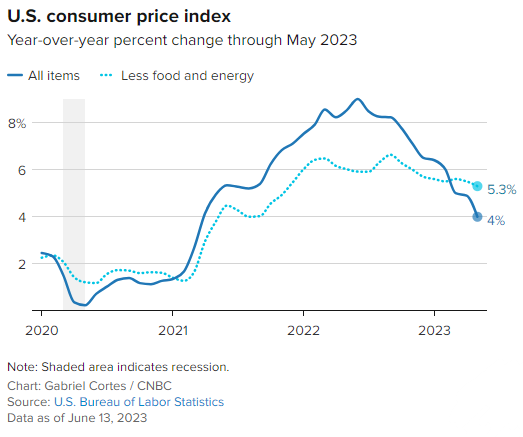

The consumer price index (CPI), a comprehensive measure of changes across numerous goods and services, saw a modest increase of only 0.1% during May, bringing the yearly level down to a mere 4%. This year-on-year augmentation, the smallest since the inflation rise of March 2021, provides a clear indication of the changing economic climate.

However, a closer look at core inflation, discounting the fluctuating food and energy prices, paints a less promising picture. Core inflation increased by 0.4% over the month, representing a 5.3% rise from the same time the previous year. This suggests that despite the easing price pressures, the cost of living continues to challenge consumers.

The data presented aligns precisely with the consensus estimates provided by Dow Jones. A significant 3.6% decrease in energy prices for May helped maintain a stable CPI. Food prices saw only a minimal rise of 0.2%.

Nonetheless, the largest contributor to the increase for the all-items CPI reading was a 0.6% rise in shelter prices, a sector that contributes to approximately one-third of the index’s weighting. Other notable increases include a 4.4% hike in used vehicle prices and a 0.8% surge in transportation services.

The release of these figures did not cause a significant ripple in the markets, with stock market futures remaining slightly positive and Treasury yields falling sharply. Meanwhile, traders in the fed funds market have shifted their pricing in anticipation of a 93% likelihood of the Fed holding benchmark rates steady in the coming Wednesday meeting.

Chief economist at LPL Financial, Jeffrey Roach, stated that, “The encouraging trend in consumer prices will provide the Fed some leeway to keep rates unchanged this month and if the trend continues, the Fed will not likely hike for the rest of the year.”

This slowing in CPI rise presents positive implications for workers as well. Inflation-adjusted average hourly earnings increased by 0.3% over the month, as indicated by a separate release from the Bureau of Labor Statistics. On an annual basis, real earnings have risen by 0.2%, a stark contrast to the negative growth seen throughout the previous inflation surge.

A growing discrepancy between the core and headline numbers was revealed in the consumer price index report. The all-items index, which typically surpasses the ex-food and energy measure, has not done so in recent times.

Ultimately, consumers are seeing the impact of this shift in their everyday expenses. With the recent 19.7% decrease in gasoline prices and food prices showing a 6.7% year-on-year increase, there is hope for a more manageable cost of living in the future.

Be First to Comment